Scaling Climate Finance: At What Cost? - SBTi at a Crossroads

This week, the Science Based Targets Initiative (SBTi) announced that it will allow the use of carbon credits to meet Scope 3 targets under its standard going forward. However, SBTi will not provide further details on the specific framework for this accounting until July 2024.

This decision could potentially have major implications for companies' decarbonization pathways. As the leading organization validating science-based climate targets for businesses, SBTi wields tremendous influence over how companies shape their climate strategies. The recent move to permit carbon offsetting as a means to achieve climate goals is therefore highly controversial.

The Complicated Relationship with the Carbon Market

In making this call, SBTi upends its long-held position on the voluntary carbon market. Until now, it had sanctioned just two uses of carbon credits tied to climate targets. The Corporate Net Zero Standard originally envisioned tapping removal project credits to neutralize residual emissions after a 90% reduction - though SBTi has yet to specify which credits qualify. The other approved use is under the current FLAG Standard, where certain removal activities like agroforestry can be implemented within a company's value chain and counted towards its target - an approach known as "insetting" adopted by firms like Nestlé in pursuit of net-zero.

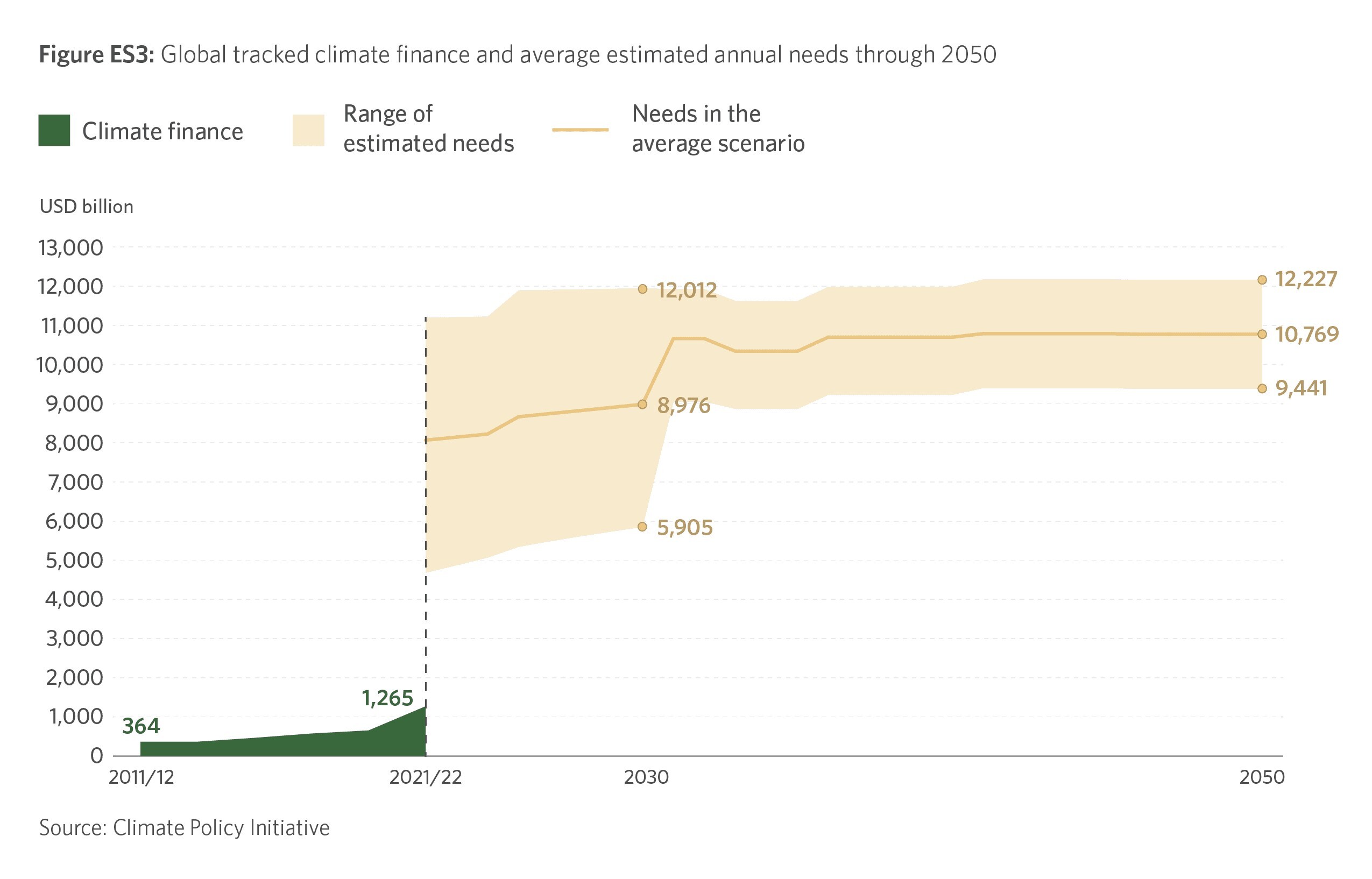

Now, however, SBTi plans to forge new paths involving carbon credits. Just this past February, its new guidance weighed in on the concept of "beyond value chain mitigation" (BVCM) - outlining how companies can accelerate global decarbonization by backing climate projects outside their operations. Yet SBTi maintained then that such contributions couldn't be credited towards a company's own goals, even as it stressed urgent financing is critical to capping warming at 1.5°C - a valid point, considering the Climate Policy Initiative estimates $8 trillion in annual climate finance is needed, seven times current levels, with the voluntary market a mere $2 billion drop in the bucket.

Source: Climate Policy Initiative, Global Landscape of Climate Finance 2023

However, SBTi's latest decision could dramatically alter that landscape. In a study last fall, MSCI Carbon Markets modeled a similar scenario. If all companies with a validated SBT were to close their current emissions gap in Scope 3 through carbon credits, it would generate an additional $19 billion in annual climate finance and up to $65 billion by 2030 (Note: these figures should be treated with caution).

Are Climate Targets Still Science-Based?

SBTi's decision carries many risks and reflects a fundamental conflict: Should SBTi remain a pure standard-setting body for climate targets, or should it take a more active role in shaping corporate strategies? While SBTi claims in its statement that the mitigation hierarchy (avoid, reduce, offset) must still be upheld, its decision potentially allows companies to circumvent this rule. Realistically, there's little transparency into the complex deliberations companies undertake. It will likely come down to each company's discretion whether they invest in decarbonizing their value chain or purchase credits instead. If the BVCM approach takes hold as a substitute rather than a supplement to companies' own decarbonization efforts, it could ultimately undermine climate progress.

The risk of promoting inaction is significant. For many companies, Scope 3 represents the lion's share of emissions - averaging 75% according to CDP, though varying significantly by industry. Decarbonizing opaque, complex value chains poses a major challenge, often incurring prohibitive costs and efforts. SBTi's Supplier Engagement Target offers a pragmatic solution, but the new option to reduce Scope 3 externally now jeopardizes this successful model.

Source: CDP, CDP Technical Note: Relevance of Scope 3 Categories by Sector

Moreover, climate protection projects frequently face criticism for failing to deliver promised emissions reductions. Enforcers of quality standards like ICVCM now shoulder a heavy burden in the voluntary carbon market. Public demands for integrity will undoubtedly intensify following SBTi's decision.

Where to go from here?

By July 2024, SBTi will issue further guidelines detailing its new policy. The clearer the requirements, the better potential risks can be mitigated. Specifically, SBTi must clarify:

- Quality Standard: Will it adhere to ICVCM's Core Carbon Principles or define its own criteria? Will the methodology build on existing removal approaches or allow avoidance projects?

- Application Scope: Are all Scope 3 emissions eligible for compensation, or just a portion (e.g. VCMI's 50% "flexibility claim")? Will a strict ton-for-ton approach be required, or will other financing models be accepted?

- Monitoring: How will SBTi verify compliance with the mitigation hierarchy? What reporting will be mandated to ensure transparent, verifiable alignment with climate targets?

There's no doubt SBTi has opened a new chapter in the climate debate. Whether relaxing companies' abatement obligations spurs more or less decarbonization remains to be seen over time.