3 reasons why your company should introduce an internal carbon tax

The internal carbon tax is an instrument within a company that puts a price on the greenhouse gas emissions caused, promotes innovation and increases operational efficiency. It is a strategic mechanism that allows companies to better manage and internalise the climate impact of their activities. The pricing of CO2 is one of the best practice measures that will distinguish your company as a pioneer in sustainability. We therefore recommend that our Gold Label holders consider introducing a carbon tax. Swiss Climate will be happy to assist you with the implementation of an effective carbon tax in your company.

1 What is an internal carbon tax?

An internal carbon tax (internal carbon tax or carbon fee) is a mechanism for voluntarily levying a monetary amount per tonne of CO2 (CHF/tCO2) emitted within a company. The amounts collected are managed by your company and are generally used for climate protection activities. Your company's CO2 footprint becomes a financially relevant key figure and your climate costs become visible. As a result, the internal carbon tax has a positive impact on business decisions.

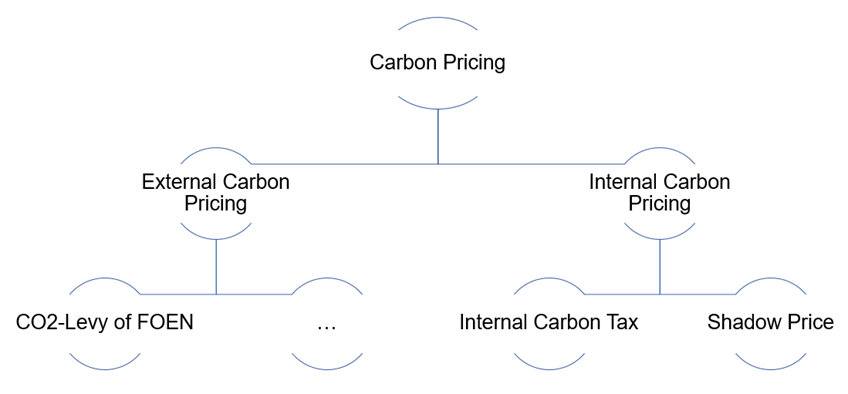

In addition to the internal carbon tax, related concepts belong to the upper category of "Carbon Pricing", which are not discussed in detail in this blog.

CO2 pricing can take place voluntarily within a company (internal carbon price) or be regulated by legislation (external carbon price). One example of an external carbon price is the CO2 levy on fossil fuels, which was introduced in Switzerland by the CO2 Act.

There are two basic forms of internal carbon prices: The internal Carbon Tax (or internal carbon fee) and the Shadow Price. A shadow price is used to include a hypothetical CO2 price in strategic decisions, such as in investment calculations, without generating additional cash flow movements. A shadow price is of particular interest to large companies that want to reduce financial risks and follow the recommendations of TCFD. The main difference to the internal carbon tax is that the shadow price does not charge a monetary amount for climate protection activities.

2 How can an internal carbon tax help your company?

The introduction of an internal carbon tax brings 3 main benefits to your company: Acceleration of emissions reduction, capital mobilisation and leadership:

- Accelerating the reduction of emissions: The internal carbon tax makes climate costs visible, creates additional incentives to consider the CO2 emissions of business activities in corporate decisions and thus increases the pressure to act. It has a steering effect towards climate protection and can have an impact across all areas of the company. As part of a holistic climate strategy, it supports your company in efficiently reducing the greenhouse gas emissions caused. A faster reduction of the footprint prepares your company for a low-emission economy and minimises climate-related risks.

- Capital mobilisation: By levying the internal carbon tax, capital is generated that your company can use to finance climate protection activities. The sum depends on the progress made in reducing the footprint and can be used for reduction measures within the company or to finance a climate protection project within or outside the value chain.

- Leadership: The internal carbon tax is one of the best practices for effective climate protection. It is a powerful tool that can be used to communicate with various stakeholders. From investors asking for resilience and sustainable practices, young talents who are looking for attractive employers, through to responsible customers, stakeholders of your company will see this tool as a testimony to climate commitment. Internally, the carbon tax promotes employee awareness and engagement by serving as a means of raising awareness and driving collective action for a more sustainable future.

3 How does the carbon tax work?

The carbon tax can be customised according to your company's objectives. It can be applied to the company's entire footprint or only to certain areas of the company or activities (such as air travel). The amount can vary depending on the intended use and can be set at different levels for different emission sources.

Swiss Climate recommends that ambitious companies, such as the holders of the Swiss Climate Gold Certificate, consider introducing a carbon tax. Swiss Climate will be happy to advise you on how to proceed.

Would you like to introduce a carbon price in your company? Wondering where to start? Contact our experts in this field.

back